Retail media is considered the third wave of digital marketing, with search and social media advertising being the first two waves. Brands looking to increase product revenue and drive lower funnel conversion can significantly benefit from retail media advertising. Additionally, retail media provides closed-loop measurement capabilities, enabling them to link ad spending directly to sales outcomes. Retail media is the fourth largest ad channel by spending, quickly approaching linear TV in third place.

Retail Media Forecasts

If you are ready to incorporate retail media into your advertising strategy, you should stay on top of the trends and retail media networks shaping the industry. According to Statista, the global retail media ad spend for 2024 was estimated to surpass $150 billion and it will continue to grow and hit the $200 billion mark in 2029. Also, the global retail media advertising revenue will reach $368 billion in 2029, with retailers forecast to attract $293 billion and non-retailers $75 billion. Retail media advertising offers you the best opportunity to find purchase intent customers who are shopping for your product or a similar competitor’s product.

What Is Retail Media Advertising?

Retail media advertising is a form of digital advertising where retailers offer brands the opportunity to advertise on their digital platforms (websites, mobile apps), in their physical stores, or use their data to advertise on third-party platforms.

One of the main advantages is that it leverages the retailer's first-party data to effectively target customers at the point of purchase across categories like CPG, grocery, beauty, and more. Retail media advertising is growing rapidly because it allows brands to reach consumers with highly relevant ads, on trusted platforms, increasing the likelihood of conversion.

Types of Retail Media Advertising

The three main retail media advertising types are:

- On-site: Ads appear on the retailer's digital properties, like their website or app. For example, Amazon Sponsored Products

- Off-site: Ads use the retailer's data but appear on third-party websites, social media, and streaming platforms

- In-store: Ads are displayed within retailers’ physical store locations, such as on digital signage, in-aisle displays, and self-checkout ads

While many brands heavily invest in retail media on websites and apps, in-store retail media advertising is noticeably growing. In-store retail media ad spending is expected to increase by 47% in 2025 and surpass $1 billion by 2028.

Retailer Support DTC vs. Retail Media Marketplace Advertising

It is important to distinguish between retailer support DTC and retail media marketplace advertising.

Retailer Support DTC

Retailer support DTC focuses on driving brand growth by bringing traffic to the site via social media or other channels. The goal is not always revenue or ROAS, but brand reach and audience growth. For example, driving shoppers from TikTok to a beauty site like Ulta or Nordstrom to make a purchase. In these instances, sales can not always be tracked and engagement and impression reach are possible KPIs. The key priorities are growing exposure on retailer sites and driving the highest return on investment for the brand.

Retail Media Marketplace Advertising

Retail media marketplace advertising leverages a retailer's native platform to deliver Sponsored Product ads or other advertisements to consumers while they are browsing the retailer's site. Sponsored ads on well-known websites like Nordstrom or Walmart tend to have a high conversion rate. Targeted ads can be displayed across various categories, including consumer packaged goods (CPG), grocery, electronics, beauty, and more. You can increase traffic, impressions, and revenue via Display ads, Video ads, and other marketing strategies.

The retail media advertising approach aims to generate the highest possible return on investment for brands while enhancing their visibility on retailer sites. Generally, the key performance indicators (KPIs) for retail media include return on ad spend (ROAS), conversion rate (CVR), click-through rate (CTR), and sales growth. ROAS is the most critical retail media KPI for many brands.

What Is the Average CPC for Retail Media?

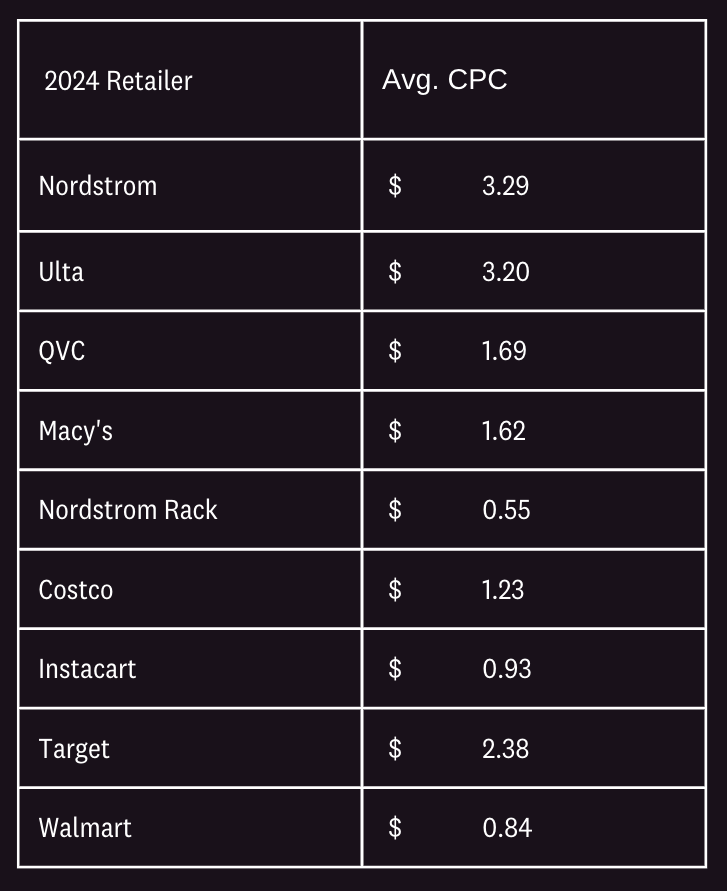

The global digital retail media cost-per-click (CPC) stood at $1.1 in late 2023, reports show. Tony Lunn, Retail Brand Manager at Blue Wheel, has analyzed various retailers to pull the average CPCs in 2024 for brands in the beauty and CPG categories. This will give you a better understanding of what to expect if you offer beauty or CPG products and advertise with retail media in 2025 and beyond.

Average CPC for Beauty and CPG

“One of the main cost-per-click trends we noticed was that Ulta and Nordstrom saw higher CPCs in 2024. Higher-end brands looking for higher-end audiences will see increased CPCs in 2025, especially around holidays and tentpole promotions”, Tony Lunn said.

“This is particularly true for Black Friday, Cyber Monday, and the holiday season, where CPCs spiked into higher ranges on Ulta and Nordstrom. Most other retailers had average CPCs of $1- $2 in 2024. Instacart and Walmart saw efficient CPCs at $0.93 and $0.84, respectively. Also, Nordstrom Rack and QVC had efficient CPCs but saw lower performance.”

How to Adjust Your Strategy Based on Retail Media Trends

Several key trends will impact CPC in retail media this year. Major platforms like Amazon, Walmart, and Target are expanding their advertising networks. As they continue to improve and gain popularity, there will be an increased demand for ad space. With more retailers investing in digital advertising, there is more competition on platforms like Google and Meta. These trends are particularly evident in the fashion, electronics, and home goods categories.

Stricter privacy regulations in 2025 will compel brands to rely more on first-party data and contextual advertising, and a major benefit of retail media is that it gives you access to retailers’ first-party data. Also, AI use and automation in ad targeting and bidding strategies will continue to expand. Social media apps like Instagram, TikTok, and Pinterest are becoming increasingly integral to retail media marketing strategies. As these platforms enhance their shopping features, the competition for ad placements grows.

What Can You Do?

How can you adjust your retail media advertising strategy to these trends? You should optimize your ad strategies, create high-quality content, and leverage data analytics to maximize return on investment (ROI). Diversifying ad spending across multiple platforms and exploring new, emerging channels can also help mitigate the impact of rising CPCs.

What Are the Top Retail Media Networks in 2025?

Today, there are over 200 retail media networks worldwide, with Amazon, Walmart, and Target standing out as leaders with their retail media platforms. A retail media agency like Blue Wheel can help you select the right networks and support your retail media strategy.

Amazon Advertising

In 2024, Amazon was the largest retail media network, dominating the landscape with an estimated retail media ad revenue of $52.7 billion. The platform gives you access to its valuable first-party data, allowing you to reach highly targeted audiences with various ad formats.

Utilize Sponsored Brands and Sponsored Products to increase visibility and drive sales. You can also use Amazon’s Demand-Side Platform (DSP) for programmatic advertising to reach a broader audience.

Walmart Connect

Walmart Connect is Walmart’s in-house advertising platform designed to help brands engage with shoppers across its extensive digital and physical store network. Utilize Walmart Connect for targeted advertising using Walmart’s extensive first-party data.

Focus on Sponsored Products, Display, and Search ads on Walmart’s digital properties. Combine online campaigns with in-store promotions, leveraging Walmart’s in-store digital screens and self-checkout ads to create a seamless shopping experience.

Target’s Roundel

Roundel is Target’s retail media network, designed to assist brands connect with Target’s extensive customer base through various advertising solutions. It uses Target’s rich shopper insights and data to create personalized and effective advertising campaigns, helping brands reach the right audiences.

Leverage Target’s Roundel for data-driven advertising solutions. Use personalized ads across Target’s digital properties and partner sites and integrate digital campaigns with in-store promotions to drive online and offline traffic.

Instacart Ads

Instacart partners with over 1,400 national, regional, and local retailers, providing brands with a broad reach across over 80,000 stores in the US and Canada. Instacart Ads is Instacart’s advertising platform designed to help brands reach high-intent shoppers across its network.

Use Sponsored Products ads to increase visibility and drive sales by placing products where shoppers are most likely to see them. Display ads can target specific audiences based on their shopping behavior, helping you tell your brand’s story and engage with customers throughout their shopping journey. You can also leverage Shoppable ads to drive higher conversions.

Criteo

Criteo is a global technology company specializing in commerce media and helping brands, retailers, and publishers connect with customers through targeted advertising. It offers brands various retail partners, including Target, Shipt, CVS, Walgreens, Best Buy, Macy’s, Nordstrom, Ulta, Carrefour, Costco, Meijer, and Kohl’s. Use this all-in-one platform to increase awareness and boost product sales on major retailer websites.

To Conclude

Retail media trends indicate continued growth in ad spending and revenue. An increasing number of retail media networks are emerging, while the established ones are enhancing their offerings by providing more options for brands looking to leverage first-party data and reach high-intent purchasers. Targeted retail media ads enable you to connect with shoppers both online and in physical stores.

Retail Media Tips

Monitoring cost-per-click (CPC) rates in retail media and understanding the factors influencing them can help you optimize your advertising strategy. Identify which retail media networks align best with your product types, placement strategies, and overall goals.

Blue Wheel can help you navigate the challenges of retail media advertising and provide tailored retail media support and proven expertise. Contact us to get in touch with our retail media team.

.png)

.png)